Tea production in Kenya and Sri Lanka have recorded all time high quantities in 2010.

Kenya has recorded a significant crop increase of 27 percent over 2009, to end the season at 399 mkgs. where as Sri Lanka registered a 13.67 percent to reach 329.3 mkgs.

Boosted by the high production and fairly strong demand during the year, export earnings too are at an all time high. Kenya tea export earnings in 2010 overtook horticulture as the leading export earner.

Kenya is the world’s leading exporter of black tea.

Sri Lanka’s production of 329.4 mkgs in 2010 comprises 59.11 percent from the Low Growns followed by 23.77 percent from High and 16.82 percent from Medium Grown.

Today’s 1.3 mkgs of Ex Estate teas on offer met with fair demand with prices for BOPFs being firm to Rs 5 to Rs 10 dearer at the commencement, however ended up more or less firm towards the later part of the sale. BOPs on the other hand which were firm to irregular, declined Rs 5 to Rs 10 towards the end.

A few bright Nuwara Eliya BOPs appreciated substantially, others were mostly firm. BOPFs too were irregular following quality.

The Uva BOPs were mostly firm, whilst BOPFs appreciated Rs 5 to Rs 10.

Low Grown PF1s declined Rs 20 to Rs 25, whilst High and Medium types shed but to a lesser extent. There was fair demand from the tea bag sector, whilst Russia was selective. UK, Japan and Continental buyers operated following quality.

The 3.6 mkg of Low Growns that were on offer this week, met with excellent demand. In the Leafy category, OP/OPAs advanced sharply. Pekoes too met with widespread demand with prices appreciating.

BOP1/OP1s too maintained previous levels. Although the Small Leaf started at fully firm levels, prices could not be sustained and declined as the sale progressed, particularly for Tippy varieties and FBOPs. However, the price levels are still quite attractive.

The main Russian buyers were very forceful, whilst Middle East too bid strongly. The sale of 8/9 February that closed last week saw the volumes on offer dropping to 6.1 mkg which is around 1.4 mkg lower than the previous week.

The sale of 14th February scheduled to close this Friday, is a one day auction with restricted volumes.

Here too the quantity on offer will decline to around 5.5 mkgs. The strong demand witnessed this week could primarily be due to the lower volumes on offer in the ensuing weeks.

Western Teas

A few Select Best BOPs advanced following special inquiry, other good invoices were barely steady, Below Best sorts eased Rs 5 and more, plainer varieties shed Rs 5 to Rs 10 on average. Select Best BOPFs were barely steady, other good invoices shed Rs 5 to Rs 10 following quality, Below Best sorts advanced Rs 5, plainer varieties were Rs 5 to Rs 10 dearer. Medium BOPs declined substantially, whilst BOPFs were irregularly dearer.

Nuwara Eliya Teas

A few bright BOPs advanced following special inquiry, others were firm. BOPFs were firm to Rs 5 easier.

Uva Teas

BOPs declined Rs 5 to Rs 10, whilst BOPFs were firm. Uda Pussellawa BOPs were firm to marginally easier. BOPFs gained Rs 5 to Rs 10.

CTC Teas

Low Grown PF1 declined Rs 20. BP1s were firm to Rs 5 dearer. High and Medium PF1s shed Rs 5 to Rs 10. BP1s were firm to irregular.

Low Growns

Good demand. Select Best OP1s appreciated Rs 20 to Rs 30, Best OP1s were irregularly dearer by Rs 5 to Rs 10, Clean Below Best varieties too gained Rs 10 to Rs 15, however stalky invoices were neglected.

Select Best along with the Best BOP1s were firm to Rs 10 to Rs 15 dearer, Below Best and poor sorts were firm.

Select Best OPs shed Rs 10 to Rs 20, however the Best varieties appreciated Rs 10 to Rs 15, Below Best and poor sorts were mainly firm.

Select Best OPAs maintained last levels, Best types gained Rs 10 on average, Below Best and poor sorts were firm to Rs 3 to Rs 5 lower at times.

Select Best Pekoes advanced Rs 10 to Rs 20, Best types were steady, bold Pekoe varieties were irregularly dearer by Rs 5 to Rs 10, flaky types too maintained last levels.

Select Best Pekoe1s advanced Rs 20 to Rs 30, however the balance were firm on last levels. Select Best BOP/SP were firm to dearer at times, Below Best types maintained last levels, poorer types too were firm. Select Best and Best FBOPs were firm, however Below Best types and poorer sorts eased Rs 6 to Rs 8. Select Best and Best FBOPF1s maintained last levels, however Below Best and poorer sorts were lower by Rs 5 to Rs 8.

Select Best Tippy varieties advanced a few Rupees above last, Best types were firm, Below Best and poorer sorts were slightly lower to last.

Off Grades

Select Best and Best liquoring Fngs 1s were firm to dearer by Rs 5 to Rs 10, Below Best and poorer sorts sold at firm levels at the start of the sale, whilst appreciated at the end of the sale. Select Best and Best BMs were dearer by Rs 10, whilst the Below Best and poorer sorts appreciated Rs 10 to Rs 15. All Low Grown Fngs appreciated Rs 10. All BPs were irregularly dearer by Rs 10. Select Best BOP1As were firm to dearer by Rs 10 to Rs 15 and more at times with good demand, Best and Below Best BOP1As too were dearer by similar margin, poorer types however, were lower to last by Rs 5 on average.

Dust

Select Best Dust1s along with the Best and Below Best types were firm, poorer sorts declined Rs 5 to Rs 10. Clean secondaries were firm, whilst the balance appreciated Rs 5 to Rs 10. Best Low Grown Dust/Dust1s gained Rs 5 to Rs 10 and more at times, whilst the balance were irregularly dearer.

source - www.dailynews.lk

Sri Lanka stock picks site has been developed to give first hand information with regard to share trading opportunities available for investors who do not like go through lengthy research reports, calculations,etc but to have a clear idea about stocks that have future up side potential.Our service is just not for day traders but for the investors who wish to see their money growing in the long run.Our main objective is to provide information relating to trading under one roof.

Monday, January 31, 2011

Profit taking keeps market in check

The bourse remained active during the week with the ASPI surpassing MPI midweek, however both indices have recorded a decline week on week with the ASPI closing at 7192.49 down by 0.85 percent over last week and MPI losing 127.83 points to and close at 7165.32.

The accumulated turnover for the week was Rs 19.42 billion with the daily average levels remaining at almost the same levels as that of the previous week.

The volumes dipped over the week with the average daily level of 139.52 billion as against 175.71 billion last week. Market capitalization was recorded at Rs 2.39 trillion, as compared to Rs 2.42 trillion in the preceding week.

The bourse outlined PER and PBV at 27 and 3 respectively. Banking, Finance and Insurance led the turnover tally with 22.3% sector share aggregating to Rs 4.33 billion, however the index was down by 191.14 points to end at 17,430.35.

Manufacturing, Plantations and Diversified represented 16.09 percent, 11.22 percent and 10.84 percent of total market turnover amounting to Rs 3.12 billion, Rs 2.18 billion and Rs 2.10 billion respectively. Banking sector contributed 42.19 percent to the overall share volume headed by Sampath Bank.

Horana led the Plantation Sector while Fort Land and Hayleys contributed to the Diversified sector. Sampath headed the turnover register with 6.12 percent of overall market share amounting to Rs 1.18 billion with the scrip closing the week at Rs 300.30, whilst Grain Elevators and PC House contributed 5 percent and 4 percent respectively. Lanka Aluminum the top gainer for the week closed at Rs 60.70 with a gain of 68.14 percent vis a vis last week on the back of a strategic investment by high net worth investor.

Three Acre Farm also climbed up outlining an increase of 60.91 percent against previous week.

Grain Elevators also became a top gainer in the bourse noting a northward momentum of 50.27 percent closing at Rs 197. Asian Alliance closed the week at Rs 126 recording a 30 percent decline week on week. MTD Walkers and Envi. Resources also recorded a decline of 28.71 percent and 18.51 percent respectively.

The scrips closed at Rs 60.60 and Rs 92.90 respectively. Foreign investors closed the week as net sellers amounting to Rs 779.3 million.

Foreign purchases for the week were Rs 1.02 billion and sales of Rs 11.8 billion. Market capitalization which opened the week at Rs 2,416 billion closed at Rs 2,393.47 billion.

Amana was the most traded share this week more than 82 million shares changing hands representing 12 percent of total volumes traded this week, whilst Mullers and Tess agro were the other two most traded shares for this week at 8 percent and 6 percent.

Point of view

The Colombo bourse witnessed active retail participation during the week’s trading with healthy turnover levels boosted by the movement of strategic stakes as well. Sound corporate earnings of the counters released so far have driven the plantation sector to a new height with the sector index gaining 11.5 percent during the week.

We expect investors to remain bullish on fundamentally strong counters within key sectors with sound earnings potential, while occasional profit taking to cash in on gains is expected to keep the market in check.

source - www.dailynews.lk

The accumulated turnover for the week was Rs 19.42 billion with the daily average levels remaining at almost the same levels as that of the previous week.

The volumes dipped over the week with the average daily level of 139.52 billion as against 175.71 billion last week. Market capitalization was recorded at Rs 2.39 trillion, as compared to Rs 2.42 trillion in the preceding week.

The bourse outlined PER and PBV at 27 and 3 respectively. Banking, Finance and Insurance led the turnover tally with 22.3% sector share aggregating to Rs 4.33 billion, however the index was down by 191.14 points to end at 17,430.35.

Manufacturing, Plantations and Diversified represented 16.09 percent, 11.22 percent and 10.84 percent of total market turnover amounting to Rs 3.12 billion, Rs 2.18 billion and Rs 2.10 billion respectively. Banking sector contributed 42.19 percent to the overall share volume headed by Sampath Bank.

Horana led the Plantation Sector while Fort Land and Hayleys contributed to the Diversified sector. Sampath headed the turnover register with 6.12 percent of overall market share amounting to Rs 1.18 billion with the scrip closing the week at Rs 300.30, whilst Grain Elevators and PC House contributed 5 percent and 4 percent respectively. Lanka Aluminum the top gainer for the week closed at Rs 60.70 with a gain of 68.14 percent vis a vis last week on the back of a strategic investment by high net worth investor.

Three Acre Farm also climbed up outlining an increase of 60.91 percent against previous week.

Grain Elevators also became a top gainer in the bourse noting a northward momentum of 50.27 percent closing at Rs 197. Asian Alliance closed the week at Rs 126 recording a 30 percent decline week on week. MTD Walkers and Envi. Resources also recorded a decline of 28.71 percent and 18.51 percent respectively.

The scrips closed at Rs 60.60 and Rs 92.90 respectively. Foreign investors closed the week as net sellers amounting to Rs 779.3 million.

Foreign purchases for the week were Rs 1.02 billion and sales of Rs 11.8 billion. Market capitalization which opened the week at Rs 2,416 billion closed at Rs 2,393.47 billion.

Amana was the most traded share this week more than 82 million shares changing hands representing 12 percent of total volumes traded this week, whilst Mullers and Tess agro were the other two most traded shares for this week at 8 percent and 6 percent.

Point of view

The Colombo bourse witnessed active retail participation during the week’s trading with healthy turnover levels boosted by the movement of strategic stakes as well. Sound corporate earnings of the counters released so far have driven the plantation sector to a new height with the sector index gaining 11.5 percent during the week.

We expect investors to remain bullish on fundamentally strong counters within key sectors with sound earnings potential, while occasional profit taking to cash in on gains is expected to keep the market in check.

source - www.dailynews.lk

CSE get even!

New minimum stated capital rules applicable to IPOs from April onwards are being recommended for old listed firms as well, to ensure a level playing field and higher liquidity in the Colombo Bourse.

The Colombo Stock Exchange (CSE) last week announced new rules in terms of minimum stated capital for companies keen to list in either Main or Diri Savi Boards from April onwards.

For Main Board listing, the minimum stated capital is Rs. 500 million up from Rs. 100 million at present, whilst for the Diri Savi Board it is Rs. 100 million, up from Rs. 35 million. This move is to ensure higher liquidity, which is welcome.

However, analysts said that at present a substantial number of companies out of a total of 243 listed at present fall below even the existing minimum stated capital, while a larger number will fall below the proposed new limits from April.

Analysts warned that by mid this year the bourse would run the risk of a group of companies adhering to a stringent yet welcome new set of rules whilst a majority will continue to enjoy being under the shades of old rules. “The CSE will have to ensure that there is a level playing field going forward,” analysts said, adding that existing companies must be told to comply with higher stated capital.“The respective companies could be given a timeframe to comply with in stages or face a downgrade,” they emphasised.

The same goes to the public float as minimums aren’t maintained at present, whilst a few companies have within weeks or months seen a drastic reduction in public holding.

As per CSE notice, existing rules for public float will also apply to those who are planning to list from April.

New companies wanting to be on the main board will have to ensure a minimum public holding of 25% in the hands of a minimum 1,000 public shareholders holding not less than 100 shares each.

The CSE may accept a percentage lower than 25% if it satisfied that such lower percentage is sufficient for a liquid market in such shares.

For Diri Savi Board aspirants, the minimum public holding is 10% of the total in the hands of a minimum 100 public shareholders holding not less than 100 shares each.

What is your capital?

If one ignores the future rule of minimum stated capital of Rs. 500 million for Main Board listing and Rs. 100 million Diri Savi Board listings for IPOs and analyses the existing rule of Rs. 100 million and Rs. 35 million for respective listings, there are several who are noncompliant.

However, it must be qualified that when some the old firms listed, there weren’t stated capital rules and minimum requirements.

Furthermore, though some firms' stated capital is low, their Equity and Shareholder Funds are higher on account of retained earnings and other reserves. The following are some of the companies whose stated capital are dismally low (below Rs. 30 million) than the current Rs. 100 million minimum for Main Board and Rs. 35 million for Diri Savi.

source - www.ft.lk

The Colombo Stock Exchange (CSE) last week announced new rules in terms of minimum stated capital for companies keen to list in either Main or Diri Savi Boards from April onwards.

For Main Board listing, the minimum stated capital is Rs. 500 million up from Rs. 100 million at present, whilst for the Diri Savi Board it is Rs. 100 million, up from Rs. 35 million. This move is to ensure higher liquidity, which is welcome.

However, analysts said that at present a substantial number of companies out of a total of 243 listed at present fall below even the existing minimum stated capital, while a larger number will fall below the proposed new limits from April.

Analysts warned that by mid this year the bourse would run the risk of a group of companies adhering to a stringent yet welcome new set of rules whilst a majority will continue to enjoy being under the shades of old rules. “The CSE will have to ensure that there is a level playing field going forward,” analysts said, adding that existing companies must be told to comply with higher stated capital.“The respective companies could be given a timeframe to comply with in stages or face a downgrade,” they emphasised.

The same goes to the public float as minimums aren’t maintained at present, whilst a few companies have within weeks or months seen a drastic reduction in public holding.

As per CSE notice, existing rules for public float will also apply to those who are planning to list from April.

New companies wanting to be on the main board will have to ensure a minimum public holding of 25% in the hands of a minimum 1,000 public shareholders holding not less than 100 shares each.

The CSE may accept a percentage lower than 25% if it satisfied that such lower percentage is sufficient for a liquid market in such shares.

For Diri Savi Board aspirants, the minimum public holding is 10% of the total in the hands of a minimum 100 public shareholders holding not less than 100 shares each.

What is your capital?

If one ignores the future rule of minimum stated capital of Rs. 500 million for Main Board listing and Rs. 100 million Diri Savi Board listings for IPOs and analyses the existing rule of Rs. 100 million and Rs. 35 million for respective listings, there are several who are noncompliant.

However, it must be qualified that when some the old firms listed, there weren’t stated capital rules and minimum requirements.

Furthermore, though some firms' stated capital is low, their Equity and Shareholder Funds are higher on account of retained earnings and other reserves. The following are some of the companies whose stated capital are dismally low (below Rs. 30 million) than the current Rs. 100 million minimum for Main Board and Rs. 35 million for Diri Savi.

source - www.ft.lk

US brokerage giant drops Asia and goes with TKS Securities

One of the biggest US based broking houses focusing on emerging markets, Auerbach Grayson and Co has picked new kid on the block TKS Securities as its exclusive broker in Sri Lanka.

This breakthrough for TKS puts it among 127 top broking houses in markets and countries Auberbach deals in.

The US firm previously worked with Asia Securities for which Auerbach deals accounted for around 60% of total turnover.

TKS is a Malaysian based investment house and is part of Malaysian MP and business leader Tiong King Sing owned TKS Holdings, which has exposure to finance, real estate and hotels. Asia Capital is also now controlled by Malaysia-based business tycoon Vijay Eswaran.

Formed by a group of highly experienced management team comprising veteran stockbrokers and key executives, TKS saw several of Asia Securities senior staff joining.

TKS’ lead consultant is top fund manager and investor Asanga Seneviratne who co-founded Asia Capital. TKS team headed by former Chief Operating Officer Hussain Gani who is the CEO/ Director also includes key executives and leading brokers with experience over 15 years in equity trading/placements. Its research team is headed by Danushka Samarasinghe formerly of Asia Securities. Two other directors are Ajahn Punchihewa, Prasanna Chandrasekara also from Asia.

Auerbach relies heavily on research for its investments decisions.

TKS said the exclusive deal with Auerbach is part of ties up with few other international partners. It said that Auerbach has picked TKS as they value the professionalism and expertise of the team heading TKS Securities. The broking firm says it is in business to serve clients as a fiduciary of their investments and promises unparalleled equity trading, supported by comprehensive investment research in Sri Lanka’s capital market space.

“We take great pride in the growth of our business that has come through our referrals from satisfied clientele. We focus on stretching our services beyond Indian Ocean borders with full-fledged branch network providing live trading facilities and new online software aims to increase investor access to investment opportunities in Sri Lanka,” a TKS spokesman said.

It has also forged a strategic alliance with foreign Fund/Wealth Management Companies, world-renowned research/media firms and other local and foreign High Net Worth clientele. Among services provided by TKS are Equity Broking Services, Wealth/Portfolio Management, In-depth research on key listed Companies, Strategic Investments in listed and private placements, Mergers & Acquisition, Restructuring and Recapitalisation, Listing and IPOs and Project appraisals and development.

Major shareholder of TKS Holdings is Tiong King Sing who is the Deputy Chairman and Chief Executive Officer of Wijaya Baru Global Berhad, a company listed on the Main Board of Bersa Malaysia. He is also the President and Chief Executive Officer of Wijaya Baru Group of Companies and sits on the Board of Bintulu Port Authority. Tiong is presently a Member of Parliament of Malaysia.

source - www.ft.lk

This breakthrough for TKS puts it among 127 top broking houses in markets and countries Auberbach deals in.

The US firm previously worked with Asia Securities for which Auerbach deals accounted for around 60% of total turnover.

TKS is a Malaysian based investment house and is part of Malaysian MP and business leader Tiong King Sing owned TKS Holdings, which has exposure to finance, real estate and hotels. Asia Capital is also now controlled by Malaysia-based business tycoon Vijay Eswaran.

Formed by a group of highly experienced management team comprising veteran stockbrokers and key executives, TKS saw several of Asia Securities senior staff joining.

TKS’ lead consultant is top fund manager and investor Asanga Seneviratne who co-founded Asia Capital. TKS team headed by former Chief Operating Officer Hussain Gani who is the CEO/ Director also includes key executives and leading brokers with experience over 15 years in equity trading/placements. Its research team is headed by Danushka Samarasinghe formerly of Asia Securities. Two other directors are Ajahn Punchihewa, Prasanna Chandrasekara also from Asia.

Auerbach relies heavily on research for its investments decisions.

TKS said the exclusive deal with Auerbach is part of ties up with few other international partners. It said that Auerbach has picked TKS as they value the professionalism and expertise of the team heading TKS Securities. The broking firm says it is in business to serve clients as a fiduciary of their investments and promises unparalleled equity trading, supported by comprehensive investment research in Sri Lanka’s capital market space.

“We take great pride in the growth of our business that has come through our referrals from satisfied clientele. We focus on stretching our services beyond Indian Ocean borders with full-fledged branch network providing live trading facilities and new online software aims to increase investor access to investment opportunities in Sri Lanka,” a TKS spokesman said.

It has also forged a strategic alliance with foreign Fund/Wealth Management Companies, world-renowned research/media firms and other local and foreign High Net Worth clientele. Among services provided by TKS are Equity Broking Services, Wealth/Portfolio Management, In-depth research on key listed Companies, Strategic Investments in listed and private placements, Mergers & Acquisition, Restructuring and Recapitalisation, Listing and IPOs and Project appraisals and development.

Major shareholder of TKS Holdings is Tiong King Sing who is the Deputy Chairman and Chief Executive Officer of Wijaya Baru Global Berhad, a company listed on the Main Board of Bersa Malaysia. He is also the President and Chief Executive Officer of Wijaya Baru Group of Companies and sits on the Board of Bintulu Port Authority. Tiong is presently a Member of Parliament of Malaysia.

source - www.ft.lk

Sunday, January 30, 2011

Dhammika, RCL in Rs. 20 b takeover bid of Hayleys

Acting in concert, trigger SEC’s Takeovers and Mergers Code by crossing 30% stake in manufactured export rich diversified blue chip and one of few oldest Lankan multinationals

Acting in concert, trigger SEC’s Takeovers and Mergers Code by crossing 30% stake in manufactured export rich diversified blue chip and one of few oldest Lankan multinationalsIt was untouched as well as impregnable for years, but finally two men – who are often underestimated – made it against the odds.

The duo, Dhammika and Nimal Perera – unrelated but best of buddies – yesterday triggered the SEC Takeovers and Mergers Code on manufactured export rich diversified blue chip Hayleys PLC, which is one of Sri Lanka’s few multinationals, founded in 1878.

Royal Ceramics’ (RCL) purchase of 155,000 Hayleys shares yesterday at Rs. 380 each from Jetwing Group-owned Negombo Hotels triggered the code. On Wednesday RCL bought 225,000 shares at the same price preceded by Dhammika buying around 200,000 shares on Tuesday both from S.N. Palihena, former General Manager of Bank of Ceylon.

These deals collectively pushed the combined stake of Dhammika and RCL above the SEC threshold of 30%. Dhammika’s personal stake in Hayleys is estimated to be around 28% whilst that of RCL is over 2%. Dhammika, via his currently 100% owned Vallibel One Ltd., holds a 51% stake in RCL.

The issued shares of Hayleys is 75 million and the remaining 70% stake amounts to 52.5 million shares and at the offer price of Rs. 380 per share, the takeover bid is worth Rs. 20 billion, making it the biggest ever in the corporate history of Sri Lanka. The cost of acquiring the 21% stake amounting to 15.75 million shares to get 51% control is Rs. 6 billion. Market closed before the news of the takeover bid and Hayleys saw 225,972 shares traded between a high of Rs. 399 and a low of Rs. 380 before closing at Rs. 390, down by Rs. 4.

“We triggered the code because we believe in achieving 51% control which has been our policy from the inception in all our previous endeavours,” RCL Managing Director Nimal, who was instrumental in encouraging Dhammika to enter Hayleys, told Daily FT. Dhammika is the Deputy Chairman of RCL and both serve on the Board of Hayleys with former functioning as the Deputy Chairman.

Triggering the SEC Code isn’t new to the Dhammika-Nimal duo. In fact they are masters in it. In the early and mid 2000s, the duo created a sensation by triggering the code on six companies starting from Connaissance (now Amaya Hotels and Resorts), Hotel Reefcomber, Fortress, Royal Ceramics, LB Finance and Vallibel Finance (then Rupee Finance).

These acquisitions are what made the rest of corporate Sri Lanka take notice of the duo, whose relationship has strengthened with the passage of time.

In mid June 2008, when Dhammika bought a symbolic yet strategic 7% stake in Hayleys held by Carson Cumberbatch Group at Rs. 125 per share, those who knew the duo well sensed the game plan. Thereafter he went up to 15%, after which Hayleys had to partly bite its own pride and invite Dhammika on to the Board followed by Nimal. Thereafter they kept on collecting available quantities of Hayleys, moving up to 23% in early 2010 and by October 2010, the collective stake was around 29%.

With a 30%+ stake along with around a 9% stake held by Hayleys subsidiaries, Dhammika has effective control, but it appears that they will be comfortable only with 51%.

The internal arrangement ESOP owns around a 9% stake in Hayleys as well. Hayleys’ former iconic Chairman D.S. Jayasundera’s Trust holds 11.6%.

Hayleys has been susceptible to takeover bids or ideas. A way to counter these threats was to float the ESOP. There were reports or rumours in the past of Carson Group being keen, but that it backed out due to resistance from within. Thereafter, fresh rumours surfaced during the active days of Lankan-born US Hedge Fund Manager Raj Rajaratnam, who held a substantial stake.

A senior business leader recalled that a former Hayleys Board Director, the late M.T.L. Fernando of Ernst & Young Sri Lanka fame, maintained that Hayleys was impregnable to outsiders. In that respect, the Dhammika and Nimal duo have made history.

Founded in 1878 as Chas P. Hayley & Company, Hayleys is described as one of the largest Sri Lankan multinationals. Its portfolio of globally competitive core businesses includes global markets and manufacturing, agriculture and agri business, transportation and infrastructure and consumer products and leisure. Hayleys also accounts for 2.45% of Sri Lanka’s export income.

Personally, for Dhammika, the Hayleys takeover bid comes amidst a much smaller exercise on Lanka Aluminium PLC. He triggered the SEC Code early this week when he increased the stake to 34% with the purchase of 8% at Rs. 41.50 per share. If minority shareholders accept the offer, the total cost for Dhammika will be Rs. 375 million.

The takeover bid of the number two in the industry, Lanka Aluminium, is following Hayleys acquiring a 95% stake in market leader Alumex for Rs. 2 billion late last year.

The Dhammika-Nimal duo remain dynamic. Recently they successfully raised Rs. 4.9 billion in what was the biggest private placement in Sri Lanka for Dhammika’s first holding company Vallibel One Ltd. The issuance of 196 million shares at Rs. 25 each drew Rs. 7.6 billion demand.

This private placement was a precursor to Vallibel One’s IPO at the same price in March. Vallibel One holds control of RCL, LB Finance and a 15% stake in Sampath Bank. In addition it has a leisure arm, Green Water Ltd., which is building a 382 room five star luxury resort in Negombo as well as planned investments in renewable energy projects.

Whilst third quarter results are pending, Hayleys in the first half posted a pre‐tax profit of Rs. 1.2 billion on a turnover of Rs. 24.8 billion.

Turnover grew by a solid 47% over the corresponding six months of last year, with significantly higher volumes in key sectors such as hand protection, purification and transportation and the consolidation of contributions from increased shareholdings in sectors such as textiles, leisure and plantations.

First half profit before tax reflected an improvement of 11%, despite the latter including a capital gain of Rs. 226 million. Tax expenses increased in the six months ending 30 September 2010, largely due to this reason. Consequently, profit after tax for the period at Rs. 830 million was marginally above that of last year.

source - www.ft.lk

Sunday Business News Articles

THE SUNDAY OBSERVER

THE ISLAND

THE SUNDAY TIMES

LAKBIMA NEWS

THE SUNDAY LEADER

THE BOTTOMLINE - Link Not Available

THE ISLAND

THE SUNDAY TIMES

LAKBIMA NEWS

THE SUNDAY LEADER

THE BOTTOMLINE - Link Not Available

Saturday, January 29, 2011

RPT-FUND VIEW-Emerging markets fund bets on mature market habits

* Changing consumer habits driving long-term views

* China slowdown could hit traditional EM stocks

* Frontier markets like Bangladesh, Sri Lanka attractive

By Martin de Sa'Pinto

ZURICH, Jan 26 (Reuters) - Brewers, tobacco producers and casino operators could offer the best exposure to emerging markets growth as local consumers begin to mimic counterparts in developed markets, fund manager Rajiv Jain said.

Indian and Brazilian stocks make up half Jain's portfolio, but he also likes less fashionable markets such as Indonesia. He is underweight Chinese stocks, which he said are richly valued.

"We're looking for long and sustainable trends. We want high quality growth, and like quality multinationals with emerging markets exposure which tend to pay high dividends," said Jain, who runs an emerging markets fund for Swiss bank Vontobel (VONN.S).

The tobacco industry, typically seen as defensive, offers two of his top growth picks.

"Souza Cruz (CRUZ3.SA) is Brazil's largest tobacco company with a 70 percent market share," Jain told Reuters.

"In the last 20 years, earnings rose when inflation was higher, showing they have pricing power. They are not only a defensive, they are growing," said Jain, who manages $11.2 billion in equities funds.

"And Indian tobacco company ITC (ITC.BO) has grown at an 18-20 percent clip and outgrown average Indian corporate earnings over the last decade."

But investors betting commodities and energy stocks will benefit most from productivity and prosperity growth in China and India risk heavy losses if inflation kicks in, Jain said.

"China is the world's biggest commodities consumer. If they tighten interest rates aggressively to check inflation, we could see a strong dip in commodities prices," said Jain.

The euro zone debt crisis and the weak dollar and euro are also putting a brake on emerging markets exports to the West, making long-term performers harder to find, said Jain.

He said his fund underweights energy and basic materials, since the United States, Japan and Europe remain the main consumers, despite the rise of emerging markets demand.

source - in.reuters.com

* China slowdown could hit traditional EM stocks

* Frontier markets like Bangladesh, Sri Lanka attractive

By Martin de Sa'Pinto

ZURICH, Jan 26 (Reuters) - Brewers, tobacco producers and casino operators could offer the best exposure to emerging markets growth as local consumers begin to mimic counterparts in developed markets, fund manager Rajiv Jain said.

Indian and Brazilian stocks make up half Jain's portfolio, but he also likes less fashionable markets such as Indonesia. He is underweight Chinese stocks, which he said are richly valued.

"We're looking for long and sustainable trends. We want high quality growth, and like quality multinationals with emerging markets exposure which tend to pay high dividends," said Jain, who runs an emerging markets fund for Swiss bank Vontobel (VONN.S).

The tobacco industry, typically seen as defensive, offers two of his top growth picks.

"Souza Cruz (CRUZ3.SA) is Brazil's largest tobacco company with a 70 percent market share," Jain told Reuters.

"In the last 20 years, earnings rose when inflation was higher, showing they have pricing power. They are not only a defensive, they are growing," said Jain, who manages $11.2 billion in equities funds.

"And Indian tobacco company ITC (ITC.BO) has grown at an 18-20 percent clip and outgrown average Indian corporate earnings over the last decade."

But investors betting commodities and energy stocks will benefit most from productivity and prosperity growth in China and India risk heavy losses if inflation kicks in, Jain said.

"China is the world's biggest commodities consumer. If they tighten interest rates aggressively to check inflation, we could see a strong dip in commodities prices," said Jain.

The euro zone debt crisis and the weak dollar and euro are also putting a brake on emerging markets exports to the West, making long-term performers harder to find, said Jain.

He said his fund underweights energy and basic materials, since the United States, Japan and Europe remain the main consumers, despite the rise of emerging markets demand.

source - in.reuters.com

Market dips as investors take profits

During the week the All Share Price Index (ASPI) lost 61.52 points to close at 7,192.49 points, while the Milanka Price Index (MPI) declined by 127.663 points to close at 7,165.32 points. The daily average turnover was SLRs.3.9bn compared to SLRs.3.8bn last week and the week ended with foreign buying amounting to SLRs. 1.02bn whilst foreign selling was SLRs.1.8bn.

On Monday the market closed up with ASPI and MPI reporting marginal gains of 7.36 points and 5.62 points respectively while total turnover amounted to SLRs.4.1bn. Day's largest turnover was reported on MTD Walkers with new shares issued by way of rights issue commencing trading. Day's most heavily traded Amana Takaful posted day's second largest turnover with more than 45mn shares traded between SLRs.3.90 and 4.50 to close up 17.6%. Environmental Resources Investment (GREG), Colombo Fort Land & Building were also amongst the top turnover contributors. Three Acre Farms (TAFL) which closed up SLRs.24.60 (22.6%) at 133.60 was amongst day's most heavily traded top gainers.

On Tuesday approximately 5.8mn voting shares of Laugfs Gas traded between SLRs.47.10 and 51.00 posting day's single largest turnover followed by Ceylon Grain Elevators which closed up SLRs.18.40 (13%) at 161.00 with more than 1.4mn shares actively traded. Lanka Aluminum which closed up SLRs.15.90 (39%) at 56.90 was highlighted as the top gainer for the day followed by TAFL which closed up 19% making a significant contribution in terms of turnover. Market closed on a negative note with ASPI and MPI losing 36.13 points and 57.65 points respectively.

On Wednesday total turnover amounted to SLRs.5Bn of which the largest share of SLRs.646 was generated on Sampath Bank (SAMP) which closed up SLRs.8.70 at 299.90. Approximately 2.1mn shares of SAMP traded during the day of which 1.3mn shares traded by way of crossing at SLRs.300.00. There was avid interest on plantation sector counters in anticipation of improved profitability. Horana Plantations closed up 33.5% at SLRs.70.50 being the day's top gainer with more than 5mn shares traded, followed by Elpitiya Plantations which closed up 30.3%, Hapugastenne Plantation with 29.4% and Agalawatte Plantation with 24%. C.W.Mackie closed up SLRs.19.30 (19.8%) at 116.70 making a significant contribution to turnover. Indices reported mixed results with ASPI gaining 16.63 points while MPI losing 20.07 points.

Indices declined on Thursday as both ASPI and MPI closed down 30.76 points and 25.03 points respectively. Total turnover for the day amounted to SLRs. 4.1bn with PC House making the highest contribution of SLRs.515mn. Approximately 16.8mn shares of PC House were traded during the day of which 3.71mn shares traded by way of a crossing at SLRs.27.00. PC House was also amongst the top gainers for the day as the counter closed up 19.6% at SLRs.30.50. Sampath Bank reported the day's second largest turnover of SLRs. 456mn which included three crossing amounting to 1.07mn shares at SLRs.301.00.

Indices continued to decline on Friday as ASPI lost 18.62 points while MPI closed down 30.50 points. Ceylon Grain Elevators which closed up SLRs.14.60 at SLRs. 197.00 reported the day's largest turnover of SLRs. 202mn. PC House continued to be heavily traded with approximately 6.2mn shares changing hands generating a turnover of SLRs.194mn. Lanka Aluminum reported the reported the day's biggest gain with the counter closing up 28.9% at SLRs. 60.70. Total turnover for the day amounted to SLRs. 2.8bn.

Profit taking seen during the latter part of the week is likely to ease off in the coming week as strong corporate earnings are reported by the companies.

source - www.dailymirror.lk

On Monday the market closed up with ASPI and MPI reporting marginal gains of 7.36 points and 5.62 points respectively while total turnover amounted to SLRs.4.1bn. Day's largest turnover was reported on MTD Walkers with new shares issued by way of rights issue commencing trading. Day's most heavily traded Amana Takaful posted day's second largest turnover with more than 45mn shares traded between SLRs.3.90 and 4.50 to close up 17.6%. Environmental Resources Investment (GREG), Colombo Fort Land & Building were also amongst the top turnover contributors. Three Acre Farms (TAFL) which closed up SLRs.24.60 (22.6%) at 133.60 was amongst day's most heavily traded top gainers.

On Tuesday approximately 5.8mn voting shares of Laugfs Gas traded between SLRs.47.10 and 51.00 posting day's single largest turnover followed by Ceylon Grain Elevators which closed up SLRs.18.40 (13%) at 161.00 with more than 1.4mn shares actively traded. Lanka Aluminum which closed up SLRs.15.90 (39%) at 56.90 was highlighted as the top gainer for the day followed by TAFL which closed up 19% making a significant contribution in terms of turnover. Market closed on a negative note with ASPI and MPI losing 36.13 points and 57.65 points respectively.

On Wednesday total turnover amounted to SLRs.5Bn of which the largest share of SLRs.646 was generated on Sampath Bank (SAMP) which closed up SLRs.8.70 at 299.90. Approximately 2.1mn shares of SAMP traded during the day of which 1.3mn shares traded by way of crossing at SLRs.300.00. There was avid interest on plantation sector counters in anticipation of improved profitability. Horana Plantations closed up 33.5% at SLRs.70.50 being the day's top gainer with more than 5mn shares traded, followed by Elpitiya Plantations which closed up 30.3%, Hapugastenne Plantation with 29.4% and Agalawatte Plantation with 24%. C.W.Mackie closed up SLRs.19.30 (19.8%) at 116.70 making a significant contribution to turnover. Indices reported mixed results with ASPI gaining 16.63 points while MPI losing 20.07 points.

Indices declined on Thursday as both ASPI and MPI closed down 30.76 points and 25.03 points respectively. Total turnover for the day amounted to SLRs. 4.1bn with PC House making the highest contribution of SLRs.515mn. Approximately 16.8mn shares of PC House were traded during the day of which 3.71mn shares traded by way of a crossing at SLRs.27.00. PC House was also amongst the top gainers for the day as the counter closed up 19.6% at SLRs.30.50. Sampath Bank reported the day's second largest turnover of SLRs. 456mn which included three crossing amounting to 1.07mn shares at SLRs.301.00.

Indices continued to decline on Friday as ASPI lost 18.62 points while MPI closed down 30.50 points. Ceylon Grain Elevators which closed up SLRs.14.60 at SLRs. 197.00 reported the day's largest turnover of SLRs. 202mn. PC House continued to be heavily traded with approximately 6.2mn shares changing hands generating a turnover of SLRs.194mn. Lanka Aluminum reported the reported the day's biggest gain with the counter closing up 28.9% at SLRs. 60.70. Total turnover for the day amounted to SLRs. 2.8bn.

Profit taking seen during the latter part of the week is likely to ease off in the coming week as strong corporate earnings are reported by the companies.

source - www.dailymirror.lk

SEC plans crackdown on shell companies

By Thushantha Jayatilaka

Securities and Exchange Commission of Sri Lanka is planning a crackdown on the Non Performing Listed Companies (NPLC) in the Colombo bourse- which are popularly known as shell companies- in order to prevent various kinds of wrongdoings by these companies and those who invest in them.

With regard to this, the SEC plans to make amendments to Listing Rules relevant to NPLC and have sought public comments in doing that following presentation of a consultation paper.

According to a recent study done by the Corporate Affairs Division of the SEC, some companies continue to be listed even though they are incurring heavy losses for several years, thus depleting reserves of those companies.

Further the study has found out that certain companies have paid dividends which have ceased their business operations from their issued capital which is a violation of the Companies Act No. 17 of 1982.

Some companies remain listed in the bourse despite closing operations and significant assets have been sold off. Furthermore auditors of those companies have modified their reports on the company's ability to continue as an on going concern and have issued disclaimers of opinions on the financial statements of these companies.

The SEC study also revealed that NPLC's has been bought by certain parties for certain advantages, such as avoiding initial listing requirements to list in the main board by way of acquiring shares of an existing non performing listed company at a cheaper price thereby reducing the public float.

According to the SEC, the current regulatory framework for non performing companies does not allow for a mechanism to closely monitor and regulate non performing listed companies. However with the new Companies Act of 2007 a new provision was introduced to deal with companies with a serious loss of capital.

As per the Section 220 of the Companies Act No 07 of 2007, a director of a company shall call an extraordinary general meeting of shareholders if the company's net assets are less than half of its stated capital. The notice of that meeting shall include a report prepared by the board of directors to inform the nature and extent of the losses incurred by the company and steps are taken to prevent such losses in the future.

According to the consultation put forward by the SEC on this purpose, it maintains the necessity to integrate these pieces of legislation in the Companies Act to listing rules for NPLCs.

source - www.dailymirror.lk

Securities and Exchange Commission of Sri Lanka is planning a crackdown on the Non Performing Listed Companies (NPLC) in the Colombo bourse- which are popularly known as shell companies- in order to prevent various kinds of wrongdoings by these companies and those who invest in them.

With regard to this, the SEC plans to make amendments to Listing Rules relevant to NPLC and have sought public comments in doing that following presentation of a consultation paper.

According to a recent study done by the Corporate Affairs Division of the SEC, some companies continue to be listed even though they are incurring heavy losses for several years, thus depleting reserves of those companies.

Further the study has found out that certain companies have paid dividends which have ceased their business operations from their issued capital which is a violation of the Companies Act No. 17 of 1982.

Some companies remain listed in the bourse despite closing operations and significant assets have been sold off. Furthermore auditors of those companies have modified their reports on the company's ability to continue as an on going concern and have issued disclaimers of opinions on the financial statements of these companies.

The SEC study also revealed that NPLC's has been bought by certain parties for certain advantages, such as avoiding initial listing requirements to list in the main board by way of acquiring shares of an existing non performing listed company at a cheaper price thereby reducing the public float.

According to the SEC, the current regulatory framework for non performing companies does not allow for a mechanism to closely monitor and regulate non performing listed companies. However with the new Companies Act of 2007 a new provision was introduced to deal with companies with a serious loss of capital.

As per the Section 220 of the Companies Act No 07 of 2007, a director of a company shall call an extraordinary general meeting of shareholders if the company's net assets are less than half of its stated capital. The notice of that meeting shall include a report prepared by the board of directors to inform the nature and extent of the losses incurred by the company and steps are taken to prevent such losses in the future.

According to the consultation put forward by the SEC on this purpose, it maintains the necessity to integrate these pieces of legislation in the Companies Act to listing rules for NPLCs.

source - www.dailymirror.lk

Friday, January 28, 2011

Tata Motors May Sell Nano Car in Thailand, Sri Lanka (Update2)

By Chris Reiter and Siddharth Philip

Jan. 28 (Bloomberg) -- Tata Motors Ltd. may expand sales of the Nano, the world’s cheapest car, to countries such as Thailand, Sri Lanka and Bangladesh as early as this year as demand for the egg-shaped vehicle rebounds in India.

“We will go after these markets one after another,” Tata Chief Executive Officer Carl-Peter Forster said yesterday at an auto-industry event in Bochum, Germany. “The Nano is a raw diamond that needs polishing.”

Nano sales are likely to climb to 8,000 to 10,000 cars a month “soon” from a current rate of 6,000 to 7,000 deliveries as the Mumbai-based automaker expands marketing for the model and continues to offer 100 percent financing to customers who can’t afford a down payment, Forster said.

The Nano’s registrations in December rose to 5,784 cars from a record low of 509 in November, Tata Motors said on Jan. 1. The manufacturer has more than doubled warranties and offered easier financing to promote the model. The December tally, a 60 percent increase from a year earlier, was below the 9,000-car monthly sales record reached in July.

Tata delivered the Nano to its first customer in July 2009. The car, which costs as little as 137,555 rupees ($3,000) in New Delhi, went on sale in India nationwide on Jan. 3 through Tata’s 874 dealerships. Deliveries had been limited to 12 states as the company worked through initial orders and ramped up production at a new factory that opened in June with annual capacity to build 250,000 of the car.

Maintenance Packages

Tata Motors fell 3.8 percent to 1,150.3 rupees at the 3:30 p.m. close in Mumbai trading. The shares gained 65 percent last year, the second-best performance on the benchmark Sensitive Index of the Bombay Stock Exchange.

The automaker is also offering maintenance packages, including one for 99 rupees a month, and inviting prospective customers to meetings with Nano owners to overcome the concerns of first-time car buyers.

The model’s sales fell on a month-on-month basis from July through November because of price increases and safety concerns following reports of at least three fires with the model. In response to the drop, Tata began a television advertising campaign and added sales points in smaller towns in December, the same month it lengthened warranties to four years or 60,000 kilometers (37,300 miles) and introduced the maintenance plan.

The carmaker said in November that it would retrofit Nanos with additional protection in exhaust and electrical systems after the fires. Investigations concluded that reasons for the fires were “specific” to the vehicles involved, Tata Motors has said.

To contact the reporters on this story: Chris Reiter in Bochum, Germany at creiter2@bloomberg.net; Siddharth Philip in Mumbai at sphilip3@bloomberg.net

To contact the editor responsible for this story: Neil Denslow at ndenslow@bloomberg.net

source - noir.bloomberg.com

POLL-Sri Lanka Jan y/y inflation seen steady

* What: Sri Lanka's January inflation release

* When: Monday, Jan. 31, around 3.00 p.m. (0930 GMT)

REUTERS FORECAST:

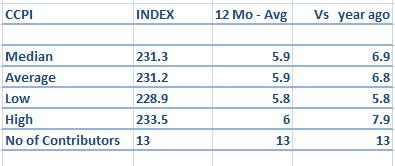

* Forecast: Both annual inflation and 12-month moving average inflation to have stabilised at 6.9 percent and 5.9 percent respectively, unchanged from December figures.

FACTORS TO WATCH:

01. Reasons for inflation stabilising. Many analysts said as in the past, the island nation's inflation figures may show

minimum changes from the previous month, despite high local and global food prices. The main opposition United National Party had said the index fails to reflect real consumer spending patterns. [ID:nSGE70J05K]

02. Impact of the recent floods on inflation. At least 21 percent of the Sri Lanka's staple rice crop has been destroyed and analysts expect a food shortage could threaten price stability, although the government has adequate stocks. [ID:nSGE70CB8P]

03. If there are signs of demand-driven inflation as the central bank surprisingly cut policy rates to six-year lows earlier this month. [ID:nSGE70A00Z]

04. Steps to curb inflation, with the post-war economy picking up and private sector credit growth expanding a more-than-expected 23.1 percent month-on-month in November in response to central bank monetary policy rate reductions. The central bank had originally expected private sector credit to grow at 15 percent by December. Sri Lanka's $50 billion economy is expected to have expanded around 8 percent last year.

05. Whether the central bank will use any tightening measures to curb possible demand-driven inflation.

06. Impact of 2011 budget proposals and relaxation of strict exchange rate controls on inflation and interest rates given the government's direction for private sector-led economic growth while agreeing to the IMF's budget deficit reduction path.

MARKET IMPACT:

01. If lower or unchanged inflation would be a welcome move for banks, which are still waiting corporate to borrow for expansions and new investments. On the other hand, corporates may take wait to see where official inflation moves amid the sharp rise in food and other commodity prices, despite low interest rates.

02. Low interest rates and low inflation will push more investors into the booming Colombo Stock Exchange .CSE, due to lower returns from fixed income instruments.

Following is the poll's forecast for the January inflation data due to be released on Monday: (Inflation figures are in percent)

Note: The following contributors participated in the poll:

Commercial Bank of Ceylon, HSBC, National Development Bank (NDB), Hatton National Bank (HNB), Bank of Ceylon, Citi Bank, CT Smith Research, TKS Securities, People's Bank, Asia Securities, Standard Chartard Bank, Nations Trust Bank, Deutsche Bank, and FCT Smith Research.

(Reporting by Shihar Aneez; Editing by Bryson Hull)

source - in.reuters.com

* When: Monday, Jan. 31, around 3.00 p.m. (0930 GMT)

REUTERS FORECAST:

* Forecast: Both annual inflation and 12-month moving average inflation to have stabilised at 6.9 percent and 5.9 percent respectively, unchanged from December figures.

FACTORS TO WATCH:

01. Reasons for inflation stabilising. Many analysts said as in the past, the island nation's inflation figures may show

minimum changes from the previous month, despite high local and global food prices. The main opposition United National Party had said the index fails to reflect real consumer spending patterns. [ID:nSGE70J05K]

02. Impact of the recent floods on inflation. At least 21 percent of the Sri Lanka's staple rice crop has been destroyed and analysts expect a food shortage could threaten price stability, although the government has adequate stocks. [ID:nSGE70CB8P]

03. If there are signs of demand-driven inflation as the central bank surprisingly cut policy rates to six-year lows earlier this month. [ID:nSGE70A00Z]

04. Steps to curb inflation, with the post-war economy picking up and private sector credit growth expanding a more-than-expected 23.1 percent month-on-month in November in response to central bank monetary policy rate reductions. The central bank had originally expected private sector credit to grow at 15 percent by December. Sri Lanka's $50 billion economy is expected to have expanded around 8 percent last year.

05. Whether the central bank will use any tightening measures to curb possible demand-driven inflation.

06. Impact of 2011 budget proposals and relaxation of strict exchange rate controls on inflation and interest rates given the government's direction for private sector-led economic growth while agreeing to the IMF's budget deficit reduction path.

MARKET IMPACT:

01. If lower or unchanged inflation would be a welcome move for banks, which are still waiting corporate to borrow for expansions and new investments. On the other hand, corporates may take wait to see where official inflation moves amid the sharp rise in food and other commodity prices, despite low interest rates.

02. Low interest rates and low inflation will push more investors into the booming Colombo Stock Exchange .CSE, due to lower returns from fixed income instruments.

Following is the poll's forecast for the January inflation data due to be released on Monday: (Inflation figures are in percent)

Note: The following contributors participated in the poll:

Commercial Bank of Ceylon, HSBC, National Development Bank (NDB), Hatton National Bank (HNB), Bank of Ceylon, Citi Bank, CT Smith Research, TKS Securities, People's Bank, Asia Securities, Standard Chartard Bank, Nations Trust Bank, Deutsche Bank, and FCT Smith Research.

(Reporting by Shihar Aneez; Editing by Bryson Hull)

source - in.reuters.com

Sri Lanka stocks close 0.2-pct lower

Jan 28, 2011(LBO) - Sri Lankan stocks closed down 0l2 percent Friday with index heavy stocks and the banks losing ground, brokers said.

The All Share Price Index closed at 7,192.49, down 0.26 percent (-18.62 points) while the Milanka Price Index of more liquid stocks closed at 7,165.32, down 0.42 percent (-30.05 points) according to stock exchange provisional figures.

Turnover was 2.8 billion rupees.

John Keells Holdings closed at 293.10, down 1.90 and Dialog Axiata closed flat at 11.60.

Sampath Bank closed at 303.30, down 2.10 rupees while Commercial Bank closed at 276.50, down 3.50 rupees.

Hatton National Bank closed at 392.10, down 0.90 cents.

Poultry stocks recovered some losses. Bairaha Farms closed 481.20, up 3.30 rupees while Grain Elevators closed 197.00, up14.60 rupees with over a million shares done and Three Acre Farms closed 180.70, up 5.50 rupees.

Reefcomber closed at 96.30, up 4.20 rupees and Royal Ceramics closed at 162.90, up 40 cents.

Hayleys closed at 395.00, up 5.00 rupees.

source - www.lbo.lk

The All Share Price Index closed at 7,192.49, down 0.26 percent (-18.62 points) while the Milanka Price Index of more liquid stocks closed at 7,165.32, down 0.42 percent (-30.05 points) according to stock exchange provisional figures.

Turnover was 2.8 billion rupees.

John Keells Holdings closed at 293.10, down 1.90 and Dialog Axiata closed flat at 11.60.

Sampath Bank closed at 303.30, down 2.10 rupees while Commercial Bank closed at 276.50, down 3.50 rupees.

Hatton National Bank closed at 392.10, down 0.90 cents.

Poultry stocks recovered some losses. Bairaha Farms closed 481.20, up 3.30 rupees while Grain Elevators closed 197.00, up14.60 rupees with over a million shares done and Three Acre Farms closed 180.70, up 5.50 rupees.

Reefcomber closed at 96.30, up 4.20 rupees and Royal Ceramics closed at 162.90, up 40 cents.

Hayleys closed at 395.00, up 5.00 rupees.

source - www.lbo.lk

Sri Lanka's The Finance raises Rs1.6bn in equity

Jan 28, 2011 (LBO) - Sri Lanka's listed The Finance Company, which is in a restructuring drive under regulatory supervision said it had raised 1.6 billion from a share sale which had been oversubscribed.

The Finance Company, earlier managed by the Ceylinco group offered 40 million shares at 40 rupees to raise capital.

Depositors at the finance company were also given a chance to convert their deposits to ordinary shares.

Depositors who convert has a chance to exit at the market price after the new issue of shares.

The stock before dilution with new shares closed at 43.90 rupees on Thursday.

The Finance had a market cap of 788 million rupees against the 1.6 billion in subscriptions attracted by the firm.

source - www.lbo.lk

The Finance Company, earlier managed by the Ceylinco group offered 40 million shares at 40 rupees to raise capital.

Depositors at the finance company were also given a chance to convert their deposits to ordinary shares.

Depositors who convert has a chance to exit at the market price after the new issue of shares.

The stock before dilution with new shares closed at 43.90 rupees on Thursday.

The Finance had a market cap of 788 million rupees against the 1.6 billion in subscriptions attracted by the firm.

source - www.lbo.lk

Sri Lanka stx down on profit-taking, foreign outflow

* Bourse down for only third session in 2011

* Market sees foreign outflow for 7th straight session

* Rupee down for 3rd day on importer dollar demand

COLOMBO, Jan 28 (Reuters) - Sri Lanka's stock market edged down on Friday for the second straight session on retail profit taking in thin volume as foreign funds continued to exit the overbought and expensive market.

The island's main share index .CSE closed 0.26 percent or 18.62 points weaker at 7,192.49, its third fall this year. It hit a record closing high of 7,261.37 on Monday after touching a new intraday peak of 7,320.22 points.

The traded share volume was 81.5 million, the lowest since Jan. 3, against a five-day average of 139.5 million. Last year's daily average volume was 69.2 million.

Foreign investors sold a net 100 million rupees' worth shares on Friday, extending the weekly net outflow to 779.3 million rupees. They have sold a net 2.8 billion rupees so far in 2011, after selling a record net 26.4 billion in 2010.

The bourse has been Asia's best performer with an 8.39 percent gain in 2011 after being the top performer last year with a 96 percent return. The recent retail buying has pushed it deeper into the overbought region with the 14-day relative strength index at 74.

The bourse is trading at a forward price-to-earnings (P/E) ratio of 18, highest among emerging markets, compared with 13 in Asian markets and 11.9 in global emerging markets, Thomson Reuters StarMine data showed.

Turnover on Friday was 2.9 billion rupees ($25.8 million), more than last year's daily average of 2.4 billion.

The rupee LKR= fell for the third straight session to close at 111.12/18 a dollar from Thursday's 111.10/111.15 on continued strong importer dollar demand, traders said.

FACTORS TO WATCH:

* Market sees foreign outflow for 7th straight session

* Rupee down for 3rd day on importer dollar demand

COLOMBO, Jan 28 (Reuters) - Sri Lanka's stock market edged down on Friday for the second straight session on retail profit taking in thin volume as foreign funds continued to exit the overbought and expensive market.

The island's main share index .CSE closed 0.26 percent or 18.62 points weaker at 7,192.49, its third fall this year. It hit a record closing high of 7,261.37 on Monday after touching a new intraday peak of 7,320.22 points.

The traded share volume was 81.5 million, the lowest since Jan. 3, against a five-day average of 139.5 million. Last year's daily average volume was 69.2 million.

Foreign investors sold a net 100 million rupees' worth shares on Friday, extending the weekly net outflow to 779.3 million rupees. They have sold a net 2.8 billion rupees so far in 2011, after selling a record net 26.4 billion in 2010.

The bourse has been Asia's best performer with an 8.39 percent gain in 2011 after being the top performer last year with a 96 percent return. The recent retail buying has pushed it deeper into the overbought region with the 14-day relative strength index at 74.

The bourse is trading at a forward price-to-earnings (P/E) ratio of 18, highest among emerging markets, compared with 13 in Asian markets and 11.9 in global emerging markets, Thomson Reuters StarMine data showed.

Turnover on Friday was 2.9 billion rupees ($25.8 million), more than last year's daily average of 2.4 billion.

The rupee LKR= fell for the third straight session to close at 111.12/18 a dollar from Thursday's 111.10/111.15 on continued strong importer dollar demand, traders said.

FACTORS TO WATCH:

- If December quarterly earnings boost the bourse

- Whether a technical correction will bring the bourse down

- If foreign funds buy shares in large volumes

Sri Lanka a ‘Virgin Market’ for anything-Analyst

By J.A. Fernando in Colombo

Colombo, 28 January, (Asiantribune.com): Economically booming Sri Lanka after ending a three decade war could be a ‘Virgin Market’ to any business or trade according to a top analyst - Director Research at Capital Trust Securities, Sarath Rajapakse.

“Our country is a ‘Gold Mine’ and there are many opportunities where we could start in new ventures in Sri Lanka,” said Rajapakse speaking to The Asian Tribune. “Sri Lanka has lots of market niches” he said.

According to Rajapakse Sri Lanka has still more space for industries such as poultry, gaming and entertainment, while there is a huge growth prospectus for what he explained as ‘Sinful Industries’ as per religious practitioners of different backgrounds.

“We are a country which has no proper entertainment industry for people, apart from set of people in a different social level who are attracted to visit Colombo city hotels and casinos for gaming and entertainment, while many people go to beaches at night for sea breeze or paddle in slight sea waves, while some are just rallying in public playgrounds killing mosquitoes. In time to come I believe that many entertainment oriented companies will be also listed like in other countries; but right now local casinos have no shortage of capital which make them need not to go public” opined Rajapakse.

Outlining his perspectives on the poultry share run that took place in Sri Lanka’s Colombo Stock Exchange at recent times, Rajapakse said that “The all time high appreciation of poultry industry related shares such as Bairaha Farms, (BFL), Three Acre farms (TAFL), Grain Elevators (GRAN) was witnessed due to the less supply from the industry where as there’s a huge demand for tones of chicken in the country.

“We are a chicken eating nation although many consider it as an unholy thing to do. So there are only a few people who are in poultry business” said Rajapakse adding that a an each member of a typical family with four to five members at least eat one kilo of chicken per week among the 20 million populace in the country.

source - www.asiantribune.com

Colombo, 28 January, (Asiantribune.com): Economically booming Sri Lanka after ending a three decade war could be a ‘Virgin Market’ to any business or trade according to a top analyst - Director Research at Capital Trust Securities, Sarath Rajapakse.

“Our country is a ‘Gold Mine’ and there are many opportunities where we could start in new ventures in Sri Lanka,” said Rajapakse speaking to The Asian Tribune. “Sri Lanka has lots of market niches” he said.

According to Rajapakse Sri Lanka has still more space for industries such as poultry, gaming and entertainment, while there is a huge growth prospectus for what he explained as ‘Sinful Industries’ as per religious practitioners of different backgrounds.

“We are a country which has no proper entertainment industry for people, apart from set of people in a different social level who are attracted to visit Colombo city hotels and casinos for gaming and entertainment, while many people go to beaches at night for sea breeze or paddle in slight sea waves, while some are just rallying in public playgrounds killing mosquitoes. In time to come I believe that many entertainment oriented companies will be also listed like in other countries; but right now local casinos have no shortage of capital which make them need not to go public” opined Rajapakse.

Outlining his perspectives on the poultry share run that took place in Sri Lanka’s Colombo Stock Exchange at recent times, Rajapakse said that “The all time high appreciation of poultry industry related shares such as Bairaha Farms, (BFL), Three Acre farms (TAFL), Grain Elevators (GRAN) was witnessed due to the less supply from the industry where as there’s a huge demand for tones of chicken in the country.

“We are a chicken eating nation although many consider it as an unholy thing to do. So there are only a few people who are in poultry business” said Rajapakse adding that a an each member of a typical family with four to five members at least eat one kilo of chicken per week among the 20 million populace in the country.

source - www.asiantribune.com

CDB pre-tax profits up 938%

Continued improvements in key performance indicators in the third quarter of 2010 enabled Citizens Development Business Finance Ltd (CDB) to record a noteworthy profit growth for the nine months ended 31 December 2010.

Continued improvements in key performance indicators in the third quarter of 2010 enabled Citizens Development Business Finance Ltd (CDB) to record a noteworthy profit growth for the nine months ended 31 December 2010.The Company’s pre-tax profit has gone up by 938% to record Rs. 331.7 million up from Rs. 31.9 million for the corresponding period last year, while revenue reached Rs. 1492 million projecting a growth of 35% over the corresponding period. CDB’s total asset base has grown from mere Rs. 276 million to Rs. 9 billion.

The annual revenue has grown from mere Rs. 25 million to around Rs.2 Bn. Net assets which recorded a negative figure in 2001 have been converted to a positive of Rs. 800 million. From the loss making status in 2001, CDB has continuously recorded growth in profitability since 2004 and posted a net profit figure surpassing Rs.300 million for the first nine months of the current financial year (2010/2011). CDB was recently assigned BBB-/P3 credit rating by RAM Rating (Lanka) Ltd. We are confident in concluding the current financial year (2010/2011) with the same momentum in bottom-line results".

Nnet interest incomegrew by 79% to Rs. 583 million, an increase of Rs. 257 million over the preceding year.

While the overall NPL ratio stood at 4.48% at 31 December 2010. The earnings per share recorded a figure of Rs. 7.83 for the period under review. Mark to market value adjustment of investment in listed shares amounting Rs.114 million also has contributed significantly to the bottom-line results.

source - www.island.lk

Global natural rubber prices to remain firm

Dr.N.Yogaratnam

Dr.N.YogaratnamThe bullish trend in natural rubber prices could continue at least till April due to the tight supply situation. Until April, a further tightness in supply will be seen due to the seasonal wintering of trees. However, from May until the year-end, supply would be back to normal, provided there are no major calamities. During wintering, production of natural rubber is known to fall.

The NR supply is expected to increase, but at a rate lower than five per cent this year. Even this is on the assumption that the weather will be normal and uprooting of aged trees will be low. Production by the ANRPC countries is expected to increase to a maximum of 9.87 million tonnes (mt), up 4.8 per cent from last year. This is in the event that the annual uprooting of rubber trees is at two per cent of the total area under cultivation.

Due to low re-planting in 2004, only 0.233 million hectares that is equivalent to 3.3 per cent of the yielding area last year, will be available for tapping this year. Moreover, high prices have prompted growers to retain aged trees, postponing replanting in the last two years. Over-aged trees and a further decline in yield may sometimes prompt farmers to uproot the trees in 2011.

In November last year, trees on 16,000 hectares were lost due to heavy winds and floods in Thailand. However, the yielding area expanded as growers tapped dormant trees last year. But the possibility of bringing more areas with dormant trees into production is limited. Rising labour costs and the possibility of changes in prices could prompt growers to keep the trees idle.

The improvement in average yield would be marginal as growers have already exploited their available short-term means on the heels of high prices. The existing yielding area is dominated by trees planted in the 1980s and the productivity of these trees would have dropped drastically on account of ageing.

There could be possible damage to yield potential due to unscientific over-exploitation of trees prompted by high prices. Abnormally high prices have made retaining low-yielding aged trees economically viable. For example, if the price of rubber was US $2 in 2007 and the yield of a 30-year-old tree was 1,100 kg a hectare, a grower would have got $2,200. This year, even if the yield are to drop to 500 tonnes and at around US $5 a kg, the grower would only get a return of $2,500.

Besides this, production in non-traditional regions where productivity potential is lower is also a concern. This is because growers in these regions do not have adequate experience in the required skills and the agro-climatic factors are also not very favourable.

Asian physical NR prices

Asian physical NR prices were high towards the end of the 3rd week of January, 2011 as futures prices on the Shanghai market hit a record high, with supply remaining thin from leading NR producers, according to reports (Table,1).

The rubber price in Thailand, the world's largest exporter, reached a record of 172.80 baht (US$5.65) per kilogram on 20th January. Demand for NR has grown based on rising car sales led by China and India. Supply may also lag behind demand as Thai production, disturbed by heavy rain last year, drops further as growers tend to avoid tapping during the wintering season that begins in February, reducing latex output.

Rubber production in Thailand during the season, which runs until May, normally shrinks by 45 percent to 60 percent from peak production. The low-production period also occurs at the same time in northern Indonesia and Malaysia, lowering output.

According to reports, buyers are still in the market despite high prices to secure the commodity amid increasing supply concerns. Futures also gained amid speculation that buyers in China, the largest consumer, may boost purchases to replenish reserves before the Lunar New Year holiday. The week-long holiday starts from 2nd February.

Natural-rubber inventories in China declined 175 tons to 68,675 tons, based on a survey of 10 warehouses, according to the Shanghai Futures Exchange, which is about 55 percent lower than last year's peak of 151,832 tons.

China's economy expanded 10.3 percent in 2010 to $6.04 trillion, the fastest pace in three years, which compares with 9.2 percent in 2009. China's vehicle sales may grow 10 percent to 15 percent this year after jumping 32 percent to 18.06 million vehicles in 2010, according to forecasts by the China Association of Automobile Manufacturers.

The unprecedented upswing in NR prices seen at the Colombo Auctions also, breaking all recent records, should be watched with caution by the producers and consumers alike for contrasting reasons.

source - www.dailymirror.lk

JKH delivers faster

The country’s premier blue chip John Keells Holdings (JKH) reinforced its prowess by overtaking its 2009/10 full year results within the first nine months of the current financial year.JKH yesterday announced a Rs. 5.7 billion net profit attributable to equity holders in the first nine months ended on 31 December, 2010 as opposed to Rs. 5.2 billion achieved in entirety of 2009/10.

The end third quarter bottom line reflected a 141% increase over the corresponding period of last financial year.

In the third quarter the figure amounted to Rs. 1.75 billion, up by 54% from a year earlier.

JKH Chairman Susantha Ratnayake’s review accompanying interim results confirmed that all sectors of the Group had delivered exceptional improvement in their performance.

Breaking away from recent traditions, JKH released its interim results last morning, just before the market opened.

In the past JKH used to release results after the market was closed and often on a Friday, given its widespread foreign shareholder base.

However investors toasted the impressive results as JKH’s stock price peaked to a high of Rs. 299, before closing at Rs. 295 – up by Rs. 3 though only 91,200 shares traded.

Group Profit Before Tax (PBT) of Rs. 2.36 billion for the quarter and Rs. 7.33 billion for the nine months reflect an increase of 57% and 118% respectively, over the PBT of Rs. 1.50 billion and Rs. 3.37 billion in the corresponding periods in the previous year.

The recurring PBT for the nine months, excluding the capital gains posted in the second quarter, grew by 65%.

The revenues at Rs. 15.62 billion and Rs. 42.50 billion in the third quarter and the nine months were 22% and 25% above the Rs. 12.75 billion and Rs. 34.06 billion recorded in the corresponding periods in the previous year.

The Company PBT of Rs. 1.12 billion for the quarter and Rs. 4.44 billion for the nine months reflect an increase of 29% and 57% above the PBT of Rs. 862 million and Rs. 2.83 billion in the corresponding periods in the previous year. The PBT for the nine months include the capital gains posted in the second quarter.

The Transportation sector’s PBT of Rs.1.97 billion was an increase of 18% over the nine months of 2009/10, which recorded Rs.1.66 billion. The quarterly PBT increased by 21% to Rs. 611 million when compared to the same period last year (2009/10 Q3: Rs.506 million). The Airlines and Logistics businesses, in particular, performed above the corresponding period in the previous year.

The Leisure sector continued to perform as expected with a PBT of Rs. 955 million for the nine months, an increase of 501% compared to the Rs. 159 million recorded in the same period last year. The third quarter PBT increased by 90% to Rs. 632 million when compared to the same period last year [2009/10 Q3: Rs.333 million].

Property recorded a PBT of Rs. 512 million for the nine months, a 194% increase over the Rs. 174 million recorded in the same period last year. The PBT of Rs. 222 million for the quarter was an increase of 224% over the corresponding period last year (2009/10 Q3: Rs.69 million).

“The cyclical nature of the revenue recognition of the Emperor project is the main reason for the variances from the previous year. We have seen positive interest from potential buyers for the ‘OnThree20,’ the 475-apartment development, situated in Union Place and launched in October 2010, with initial bookings for over 70% of the apartments, the construction of which will commence in May 2011,” Chairman Ratnayake said.

He said Consumer Foods and Retail PBT of Rs. 463 million for the nine months was 175% higher than the Rs. 168 million recorded in the same period last year. The PBT of Rs. 156 million for the quarter was an increase of 103% over the third quarter last year (2009/10 Q3: Rs.77 million).

All sectors – soft drinks, ice creams, processed meats and the super market businesses – had significantly better results for the nine months. Ceylon Cold Stores launched the Cola drink branded ‘KIK’ in December and initial results are encouraging.